The banking sector is facing significant disruption, and that is putting revenues and profitability under pressure. As customer demand for personalized relationship-based banking increases and competition intensifies, it is important to focus on effective deal management in banking along with commitment management to ensure that every deal is profitable. Calculating the business value of a deal, analyzing profitability, and then finally signing the deal with the customer is crucial. But these comprise just the first part of the corporate deal management process. It is equally important to track, monitor, and evaluate customer commitments while the deal is in play to ensure that the actual business value is aligned with the projected one. Commitment tracking is a vital part of effective corporate deal management and banks must ensure accurate and transparent processes to make this a winning proposition for both the organization as well as themselves.

Decoding the Commitment Tracking Process

The deal negotiation process is a complex one that considers the customer’s existing relationship with the bank and more importantly, certain commitments made by them at the deal negotiation stage. They may commit to conducting a certain volume or value of transactions during the specific period; that is, they commit to conducting a minimum number of transactions with an average ticket size during the tenure of the deal. Based on this the sales manager (SM)/ relationship manager (RM) calculates the expected business value and profitability of the deal before signing off on it. Benefits are offered against the customer commitments and the organization’s revenue projections are based on these as well. Therefore, it is important that the bank periodically tracks the engagement with the customer to evaluate if the ongoing metrics are aligned with minimum value and volume commitments made earlier. This is a transparent process that helps both corporate customers and banks as it provides a clear picture of the customers’ engagement vis-a-vis their commitments and gives them a heads-up to course-correct if required.

Commitment tracking is not just about evaluating a customer’s business engagement but also about their credibility and business trust. The review process considers the customer’s history with the bank. This includes the total duration of their relationship, the total business value across business lines, and several other factors including commitment tracking analysis. This process also stores historical data and uses it to assess the customer’s intent and ability to meet the committed business requirements. It is a transparent process that allows the customer the opportunity to reassess their commitments. In other words, it serves as a reality check for some customers who may have over committed. A reassessment and revamp of the deal terms based on the actual business is always possible and it helps improve the customer’s trust rating. This plays an important role when future business is being discussed.

The frequency of commitment review is usually agreed upon by the bank and the customer at the time of deal finalization though it can be modified later if required. Usually, a new business takes some time to pick up momentum. This gestation period is taken into consideration when deciding on review frequency. The process also allows for interim reviews if required or requested by either party.

How Commitment Review Works

So how does the commitment review process work? Every review involves in-depth tracking and analysis of the actual business done by the customer. This is then compared to what was committed at the time of deal commencement. These business numbers are extrapolated to arrive at the expected annual business value or volume, which helps relationship managers understand the performance of the deal. The difference between the actual and committed business for each charge is also clearly captured at this point. The relationship manager can make review notes to be referred to later as required. This is preserved in the account to be brought up at the time of audit or to settle disputes. RMs can also connect with the customer to give them a heads-up on the engagement and flag the discrepancies between the committed and actual business. Based on this analysis the RM can renew a deal (if commitments are being met), terminate a deal, deny a renewal request, or deny a request to extend a deal.

Commitment Tracking and Profitability Analysis

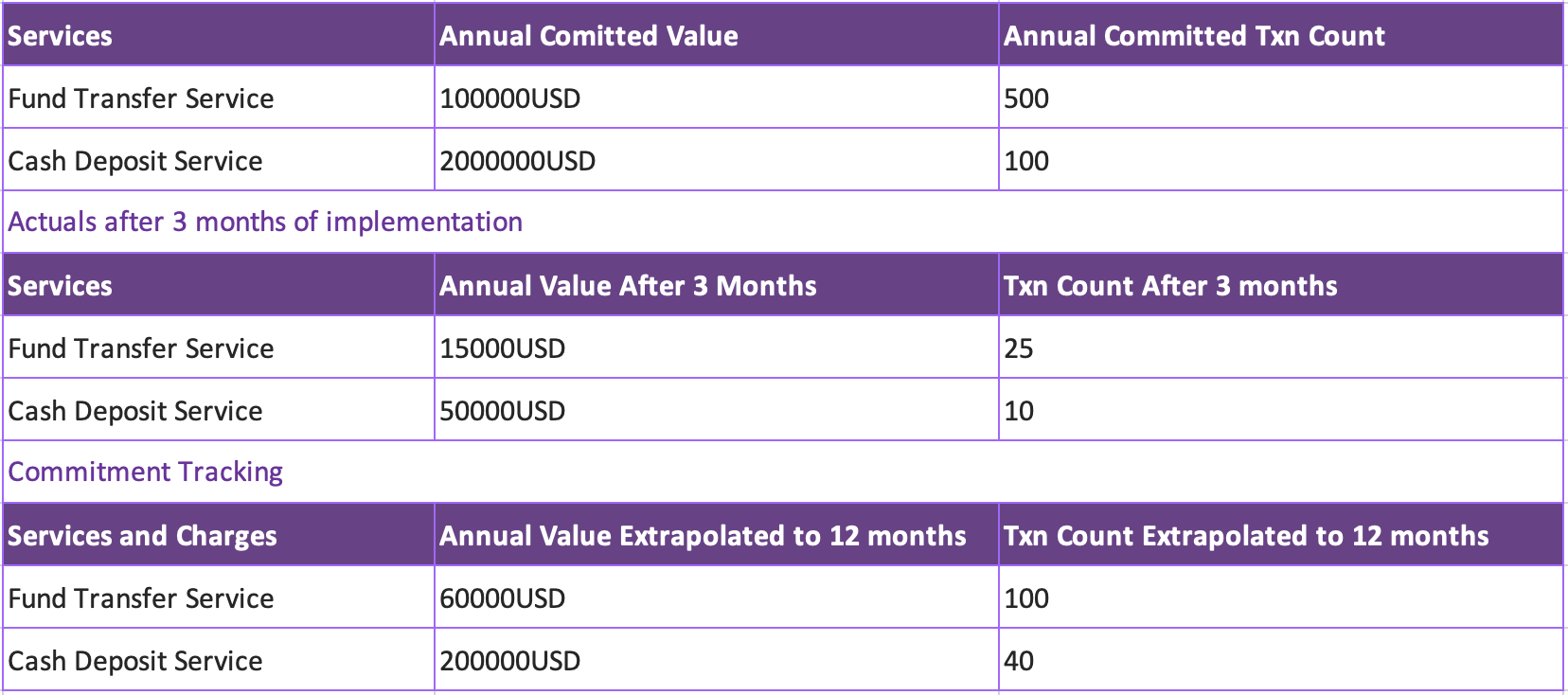

But it is not enough to just do a commitment review. When it comes to personalized deal management in banking, commitment analysis must be supplemented with actual profitability analysis for the bank to arrive at actual profits to be made off a particular business relationship. The actual value of business over a predetermined period is extrapolated to arrive at the actual business expected in a year. This is further analyzed to understand the costs involved in the deal vs the income. For example, in the figure below, the customer committed to an annual value of USD 100,000 and annual transaction count of 500 for fund transfer service. For cash deposit service they committed to USD 2000,000 and 100 transaction counts. However, the actual business velocity after 3 months fell short for both the services viz-a-viz the commitments made. These actual numbers, when extrapolated for the annual term, are short of committed numbers by a sizeable margin.

The extrapolated actual values are then substituted in place of the commitments to arrive at the actual profitability that the business might achieve, if it continues at the same velocity.

The difference in profitability percentage with the committed numbers and the extrapolated actuals is the actual shortfall or gain in profitability that the bank can expect from the deal. For example, the analysis based on committed numbers may have indicated 90 percent profitability, but based on the extrapolated actual figures this may get reduced to 70 percent. The shortfall is the variance in profitability percentage. The bank can use this analysis to give a heads-up to the customer to improve business over a period, failing which a data-backed decision can be taken to terminate the deal or to consider the larger relationship and the profitability of other deals with the customer to decide the future course of action. Of course, the variance can also be positive; that is, the actual profitability is higher than expected, which is good news for both parties.

An intelligent deal management platform can not only help in calculating business value and projected profitability but also ensure effective commitment tracking and profitability analysis based on actual business numbers. It can automate the entire process to ensure it is error free and store historical data for comparison and informed decision-making. Relationship managers can automate the review timelines based on the agreement with the customer to ensure complete transparency.

Given that the business landscape is getting increasingly challenging banks are under tremendous pressure to retain and grow revenues and profits. Signing and managing profitable deals is a critical requirement at this point, and a robust deal management platform will help banks achieve their revenue goals.