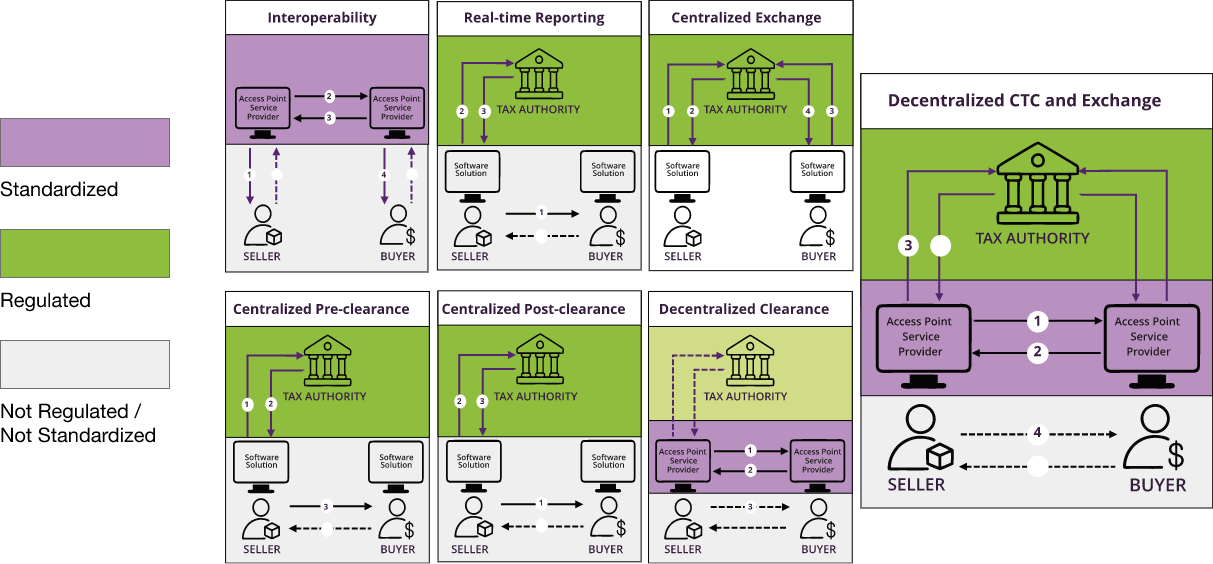

Interoperability: Electronic generation and exchange of invoices through certified service providers through an interoperable network.

SunTec e-invoicing provides the capability to electronically generate and exchange the invoice in any standard format, as prescribed by the service provider.

SunTec e-invoicing provides the capability to electronically generate the invoice in the specified format and integrate with the government authority’s CTC platform for electronic reporting in real time. As the exchange with buyer is not regulated, it is directly done between the trading parties in mutually agreed formats, mostly as PDF documents. Our product provides highly configurable capabilities for template-based PDF generation and auto emailing to customers.

SunTec e-invoicing has the capability to electronically generate the invoice in the specified format and integrate directly with the government authority’s CTC platform (V Model) for electronic reporting in real time or integrate with private platforms (Y Model), adhering to the agreed specifications.

DCTCE model is a five-corner model with the supplier, the supplier’s access point service provider, the buyer access point service provider, the buyer, and the government authority being the five corners.

SunTec e-invoicing provides the capability to electronically generate the invoice in the specified format and integrate with the any certified access point services provider.

Compliance: Ensure full adherence to international e-invoicing standards like European Standard on e-invoicing (EN), UN/EDIFACT, Peppol BIS, Peppol PINT, to name a few, and locally mandated specifications including Core Invoice Usage Specification (CIUS). This not only minimizes the risk of penalties but also shields your brand from potential reputational damage. If you are doing business across different regions in the world, e-invoicing compliance becomes even more challenging. Our product ensures you stay ahead of the latest regulatory changes, ensuring seamless compliance across diverse jurisdictions.

Flexibility: Benefit from unparalleled adaptability, seamlessly integrating with any existing accounting systems, ERP systems, and other financial systems. We ensure a smooth transition and deployment, enabling your business to maintain its operational flow without the need for extensive system overhauls.

Automation: Enhance your invoicing accuracy and staff productivity significantly by automating routine invoicing processes. Our advanced algorithms reduce manual data entry and the associated human errors, streamlining your workflows and allowing your team to focus on more strategic tasks.

Protection: Defend your sensitive financial data against the ever-growing spectrum of cybersecurity threats. Our robust security protocols are designed to thwart potential breaches, ensuring data integrity and safeguarding customer information.

Visibility: Gain instant access to critical financial data with real-time analytics and reporting features. This increased visibility into your financial operations allows for more informed decision-making, better resource allocation, and enhanced financial planning. Our dashboard provides a comprehensive overview of your invoicing landscape, helping you to manage cash flow more effectively and predict future trends.

By leveraging SunTec e-invoicing, your business can not only meet the necessary compliance requirements but also gain significant operational advantages, enhancing overall efficiency and security.

30+ years of experience in delivering pricing, billing, and revenue management solutions

The Kingdom of Saudi Arabia will go live with…

A leading financial institution in the…

A leading financial institution in the…