A cynic is a man who knows the price of everything, and the value of nothing – Oscar Wilde

Have you heard about Webvan? For the uninitiated, Webvan was a grocery delivery business that ruled the roost in the late 1990s. You could call them the forefathers of Instacart, Walmart, etc. Started in 1996, it offered services across 10 U.S. cities, was one of the most valuable start-ups at that time and had hoped to triple its market by 2001. Investors in Webvan included Yahoo! and Sequoia Capital. In 1999, it was worth $4.8 billion.

And then they tanked. Big time. From being the pantheon of e-commerce in 2000, they reached rock bottom in 2001 as they filed for bankruptcy. They were forced to donate their existing stock to local food banks and became a poster child for the ‘excesses’ of the dot-com era.

While there are innumerable case studies that list out the reasons for the failure of Webvan, one of the primary reasons that they failed was because they got their pricing wrong. Or they had the right price, but their target audience was wrong.

In the world of e-commerce delivery, there are three things that matter the most – quality, cost, and convenience.1 And it is an unstated rule that you cannot get all three together, and if you are an organization trying to make inroads into the world of grocery delivery, focus on two aspects only. If you want high quality items, and in a rapid time, the costs will go up. If you want to focus on costs, you may have to give up on convenience (read delivery times) or quality (read better items). You really cannot have your cake and eat it too. Pretty much a Schrodinger situation.

Why did Webvan get their pricing wrong? While the optimists amongst you can say that they were ahead of their time, it was certainly not the case. Yeah, they went through a tough time when cash was hard to come by, and tech companies were seen as pariahs. Yes, the market was different then where not everyone had an internet connection in their homes or their pockets. But, hey, companies like Peapod, started in 1989, survived the dotcom bust and are still going strong.

The Ingredients for The Right Price or The Pricing STRIPS

So, let me paraphrase my question. Why did Webvan’s pricing go wrong? Well, they did not have the right ingredients in place to get their pricing right. The price is ultimately and only an outcome of doing six things in the right way – the right pricing strategy, the right pricing solution or technology, the right responsibilities across the organization, having the right incentives across the organization, building the right people capabilities, and the right structure across the organization.

S – The Right Pricing Strategy

Image source: Corporater

Many people treat pricing as a tactical component of the business. It receives very less attention from the CEOs and the business leaders. In fact, a decade old study revealed that less than 5% of Fortune 500 organizations had a function that was dedicated to pricing, only 9% business schools taught pricing as a subject, and less than 15% organizations spent time and money researching on pricing.2 When we consider the fact that revenue in its simplest terms is price multiplied by number of units sold, these are alarming figures.

Organizations need to move beyond that. They need to consider pricing as a strategic lever that must be tied to overall organization strategy and vision. Organizations need to understand that the right pricing strategy is needed to communicate the right perception about the brand to their customers. It is also an important factor in positioning the organization’s product vis-à-vis its competitors while covering costs. It is a complex art, which needs to be mastered after careful consideration.

For example, let us take the case of Jio, one of the largest mobile network operators in India. It was launched in 2016, by Reliance, one of the largest corporates in India. With a strong backing, Jio disrupted the telecom market and quickly became one of the top 2 in several markets in India.

Many attribute the success of Jio to undercutting the market and disrupting the existing plans of its competitors. But I believe it was a much more focused pricing strategy that was not just about selling sim-cards at a low cost. It was aligned to the overall vision of Reliance. When Jio was launched in India, most of the telecom operators were earning nearly three-quarters of their revenue from voice-based services. Even though data and aligned services were perceived to be inexpensive in India, they were not cheap. 1GB of data a month would cost around INR 250-350 in 2016 (before the launch of Jio). This was still around 1% of what several Indians make in a month in India. And this percentage was much larger than the corresponding figures in some of the other markets across the world where data penetration was high. Jio understood that there was a market that could be exploited and captured. And they did so by launching data plans that gave data packages of nearly 1 to 2GB per day at around INR 200 per month. They could afford to do so because they aligned their overall cost structure, and the organization strategy to this price point. They lowered their costs by using reducing their operational costs of managing towers – which was a significant portion of a telecom operators cost. They also leveraged a strong product bundling strategy where they bundled VoLTE services and a host of other services such as JioCinema and JioTV with their voice services to drive up the Average Revenue Per User (or ARPU) – the single most important metric in the world of telecom. Jio was not successful because they undercut the market, they were successful because they had the right pricing strategy. Clearly it was not a fluke as is evident from the fact that Reliance share prices increased by nearly 5 times since the launch of Jio. Jio, as of 2023 is India’s largest telecom operator, outpacing its nearest competitor by nearly 20%.

T – The Right Technology and Tools

Cartoon taken from Jake likes Onions3

Not long ago, people used pen and paper, or at best Microsoft Excel to devise pricing strategies. Many still do.

But each transaction that happens between a customer and an organization generates tons of data – from the time the transaction was made, to the mode of payment that was used for the transaction. While the data points differ for a B2B transaction or a B2C transaction, the fact that each transaction generates troves of data, and thereby information, is a fact that is consistent.

Many organizations still do not have the right technology or dynamic pricing solutions to understand these data points and leverage them to create more accurate price points that reflect the needs of all stakeholders. And sometimes, some organizations do have the right tools, and understand the right data points to set the right price, but they do not have the right people or the right training to use the same. For example, McKinsey points out the case of a European steel producer who had data on overall profitability, but sales managers lacked the tools to drill down to the individual customer or product level. There was also the case of a chemical manufacturer that delivered granular data to the salesforce through a conventional business intelligence dashboard. But unfortunately, the sales reps found it too complex because while they could look at the data, they didn’t know how to draw conclusions from it, or how to build it into their dealings with customers.4

There are companies that are using these data points well. Airbnb is a great example. Airbnb considers several factors such as the listing type and the location, the customers search history for similar listings, the quality of the listing and the amenities present, the number of real-time views and the reviews, the season and the demand, the time left to book, and the availability of a particular listing and its popularity amongst a host of other factors.5 By using these data points, and leveraging their in-house technologies, Airbnb can suggest a band of price points which may increase the rate of sales and conversion.

Organizations need to invest in a right dynamic pricing solution that can do the following – capture all the right data points with respect to pricing from different systems; make sense of the data; present the data and insights in a simple and intuitive manner to the different users in the way they need; prescribe ideas and price points based on analysis; and most importantly have the right features and functionalities to be a two-way system through which the users can interact with it and play around with multiple scenarios. In the modern SaaS and API-driven economy, a dynamic pricing solution must be cloud based that can interact and connect with multiple other tools in an easy way.

R – The Right Responsibilities

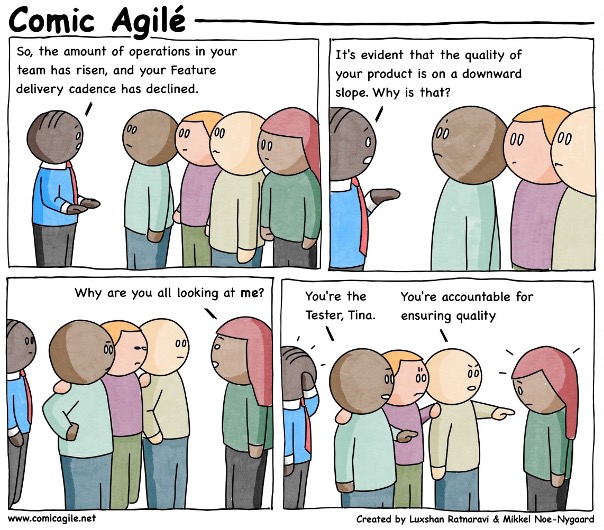

Shooting the messenger is a favourite hobby in many organizations. Yeah, there are organizations where testers are held accountable for a poor product that the developers create. Why is it so?

The answer is simple – it is because accountabilities and responsibilities are not clearly defined.

Who decides the price of a product in an organization? Is it the product manager? Or is it the area sales manager? Or is it a central pricing team? Or is it the leadership consisting of the senior most executives in an organization?

Well, the answer is not so obvious and straight forward. It depends on a lot of factors. For example, if you are selling a product where the price varies hourly, the pricing must be decentralized and preferably done by a software or an algorithm. If the price of a product is not very dynamic, a degree of centralization is always useful.

For example, consider GE, one of the most diverse business groups in the world. As Strategic Pricing Solutions mention in their blog, “The specific customers and industries in which they operate are different, the capabilities needed to serve the customers are different, and competitors are different. In such situations, pricing strategies and pricing architectures are not likely to be the same. It would not make sense to have a central pricing group try to serve all those various markets. It might make sense to have a company-wide pricing council to share best practices in analytics, tools, and processes, but it should be backed up with division-specific pricing teams that manage their respective division’s processes, analytics, and measurement, along with some limited degree of local autonomy.”6

Clearly defined responsibilities, including who sets the price, who reviews the price, and who has the authority to reset a price, will help organizations reduce confusion as well as improve profit margins. For example, as Harvard Business Review points out, ‘one North American manufacturer with margins that were highly dependent on raw material pricing suffered from an undisciplined approach to pricing. A diagnosis allocated costs at the product and customer level to determine true profitability. That diagnosis, which showed the manufacturer was undercharging in many cases, provided the support needed to raise prices where appropriate in subsequent contract negotiations, leading to an average 4% increase from that opportunity alone. The company designated an executive to be accountable for related profit margin opportunities and to track the status and effect of each price increase. As a result, the company improved earnings before interest, taxes, depreciation, and amortization by 7 percentage points.’7 7 percentage points is not a small improvement, especially if you are a listed company. Shout that out and watch that stock price goes north.

As BCG points out, clearly laid out responsibilities go beyond an excel sheet or a word document. It is about encouraging cross-functional inputs, but also ensuring a single point of accountability. It is about giving decision-making authority to those who have pricing knowledge and experience and ensuring distinct responsibilities for the pricing council (a team of experts for pricing) and the pricing organization (the team that does the actual pricing).8

Ensuring clarity in responsibilities is not just about listing out the names of accountable people for pricing. It is about clarifying the goals that the organization wants to achieve through its pricing and creating transparency and flexibility for the different stakeholders to understand the impact of changing the price. It is also about reviewing the impact of the price on the sales and the aligning it with customer and employee feedback.

I – The Right Incentives

Dilbert cartoon (Copyright owned by respective content creator)

Dilbert cartoon (Copyright owned by respective content creator)

Right incentives based on the right criteria are very important. Don’t believe me? Let me tell you the story of how an innovative incentive plan produced the wrong results for a bus operator in an Asian city. Before I proceed, let me ask you a question – who are the salespeople for a bus that plies between destination A to destination B? One of the people who are responsible for selling the bus services, and generating revenue is certainly the bus driver – he or she ensures that bus is on time so that customers are happy leading to more tickets being sold. Apparently, the bus operator in this Asian city had different ideas. The incentives for the drivers were not based on the revenue generated or the tickets sold but was based on being on-time. If you are on-time at your destination, you get more money. This led to a situation in which the drivers were not keen on picking up people in intermediate stops during peak traffic, as they were more concerned about reaching their destinations on time. Yeah, the drivers benefitted, but I am not so sure about the waiting passengers or the bus operators.9

Organizations need to not only align their prices to their organization strategy, but they also need to align their incentives to their pricing strategy. If your pricing strategy is focused on rapid growth and expansion into new markets, align your incentives to drive new market growth. Examples can be the number of new clients onboarded or new markets entered, and metrics such as profitability may not be relevant incentives. You really want your salespeople to have a range of price points from which they can sell if they want to – even at a loss. If you want to increase your foothold on existing clients or achieve profitability, create your incentive plan in such a way that the salespeople do not have much leeway in reducing the selling price beyond a certain point. Consider other metrics such as on-time performance, or customer satisfaction only when your organization strategy depends on it, and prioritizes it, and not because it is also a great metric to have.

Having the right incentives aligned to the pricing strategy is not just about having the right calculations and the right formulae. It is also about helping the people who are impacted by the employees, who are in turn impacted by the incentives. Understand the different criteria used for calculations and create the right level of transparency and interactivity. This will help employees, and especially salespeople understand the impact of their pricing decisions on not just the top-line and bottom-line of their organization, but also the way it impacts their own incentives and pay-outs.

P – The Right People and Capabilities

Dilbert cartoon (Copyright owned by respective content creator)

Pricing is not a guessing game. It requires consistent practice, research, and execution and the right set of people with the right capabilities. In other words, every organization needs a pricing team – with the requisite number of people and with the right mix of capabilities.

Organizations need to create cross-functional teams which has experts in pricing and people with multiple skills such as data analysis, economics, psychology, marketing, and product management skills. This is important because pricing teams will have to understand inputs related to prices, as well as market trends, impact on business, and how changes in pricing can be translated to product features and vice-versa. Normally, organizations create pricing teams by hiring people from industries which are famous for dynamic pricing such as airlines or hospitality. They also hire people who are part of pricing organizations. For example, when a US-based industrial goods company set up a pricing organization for pricing its products, they hired members from the Professional Pricing Society. However, the company also recruited people from within the organization across multiple divisions such as marketing, product management, and sales. They realized that their own employees had the right acumen and knowledge for pricing and needed to be trained in the use of pricing techniques and tools.10

The right size of a pricing team can depend on variety of factors which will include factors such as the revenue of the organization, the size of the overall organization, the size of its salesforce, the number of products, channels, and markets. The complexity of the pricing used by the organization, and the frequency of price changes also pays a strong part in deciding the size and capability mix of the pricing team for any organization. Studies indicate that the best-in-class large organizations have nearly two to six employees in their pricing team per $1 billion of revenue.

It is also important for organizations to consistently enhance the capabilities of the pricing organization by adding more skills, providing continuous learning capabilities, and creating research opportunities in pricing. In a world that is consistently changing, the world of pricing is also changing, and it is important that organizations support their pricing teams to be on top of these changes.

S – The Right Structure: for the organization and for the pricing team

Cartoon taken from 123rf, created by andrewgenn 11

I believe that the six factors influence the pricing output of an organization from the point of view of the structure of an organization – the degree of centralization, the size of the pricing team, the size of the organization and the size of the salesforce, the product, the market, and the customer preferences.

All these factors influence the way the price is set and the way the pricing team is structured in any organization. For example, there are organizations where pricing teams are structured by product lines, and there are organizations where pricing teams are structured and categorized by market and customer segments.

To deliver the best results, it is important that the organization structure and the structure of the pricing team focuses on a matrix relationship and emphasises on cross-functional communication and collaboration. Pricing cannot be done by one single team separated by silos. It needs inputs from multiple functions such as sales, marketing, product management, and even product engineering.

The Final Word

To create the right Caesar Salad, you need the right chicken strips. Similarly, to set the right price, and execute it in the right way, organizations need the right STRIPS – or in other words, the right strategy, the right technology, the right level of responsibilities, the right incentive models, the right people, and the right structure.

It is natural for organizations to have a strong suit. Some organizations, and especially the new-age SaaS-based companies or mobile apps leverage a strong technological backbone and hence don’t focus on having a large pricing organization. But some organizations, especially the legacy ones that span multiple markets and multiple industries rely on creating a strong pricing team, and consistently enhancing the capabilities of the same. They may rely less on new-age technologies to power their pricing. Ultimately, the key is to find the right price, set it, and execute it so that the stakeholder delight is optimized.

There may not be such a thing called the right price. And in a world which lives by the concept of dynamic pricing, the right price may change for every second customer, and every other second. The key is not to find the right price, but to have the right ingredients to set a price that may be right for each customer.