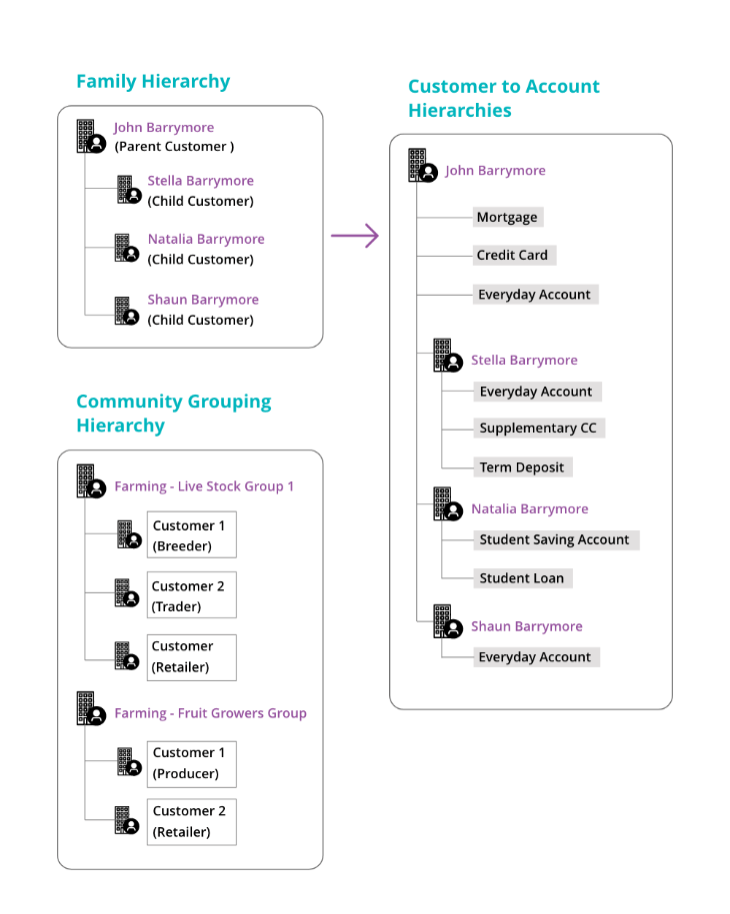

Personalized, relationship-based engagement is key for long term revenue growth and customer loyalty in the banking sector today. And the business of banking is complex, with multiple customers belonging to the same organization, or multiple members of one family banking with the same bank. One customer could even have multiple varied relationships with the same bank. The legacy infrastructure and siloed systems in use at most banks today make it difficult to get a unified view of customer engagement across business units and touchpoints. Yet, this is crucial for creating hyper personalized, relationship-based strategies. As competition increases and the fight for share of wallet gets tougher, banks must streamline operations, ensure process efficiency, and meet customer expectations of value-driven services. They must now focus on getting the overall relationship value of a customer and establish relationship-based rules of engagement.