The Dodd-Frank Act was passed in 2010 in response to the global financial crisis. Among many other things, this act lifted the restriction on banks paying interest on Demand Deposit Accounts (DDAs) held by corporate customers which had been implemented as Federal Reserve Reg. Q. It was widely expected that this would signal the end of “Earnings Credit” (EC), which is the key mechanism used by US banks on Account Analysis. Earnings Credit is essentially a “pseudo interest” figure. However, instead of being credited to the customer’s account as “interest”, this amount is used to offset certain fees that the customer must pay. It is this analysis of the monthly average balances of an account for the purpose of offsetting service charges that gives us the term Account Analysis (AA). With the prohibition on real interest eliminated by Dodd-Frank, that should have been the end of the use of Earnings Credit, right?

Almost simultaneous with the passage of Dodd-Frank, the Federal Reserve set the Fed Funds target to near zero making the conversation on hard interest, and earnings credit for that matter irrelevant. For much of the last decade, interest rates have remained remarkably low. But this is set to change because, in recent months, the Federal Reserve and central banks of other countries have begun to increase rates at a rapid pace. They have also signaled further upward revisions to combat inflationary forces. More frequent changes to interest rates will have a significant impact on both banks and their customers.

All of this is happening at a time when competitive intensity in the banking industry has increased, and incumbents face threats from both new and traditional quarters. Rapid technological advances mean that a bank’s competitive edge is shaped by how quickly its software systems enable the bank to respond to environmental changes. As interest rates rise, maximizing earnings credit, hard interest and even accounts that use a hybrid of both will become more important for customers. To deliver on higher expectations of account analysis statements and hybrid accounts, some banks may need to upgrade their software systems.

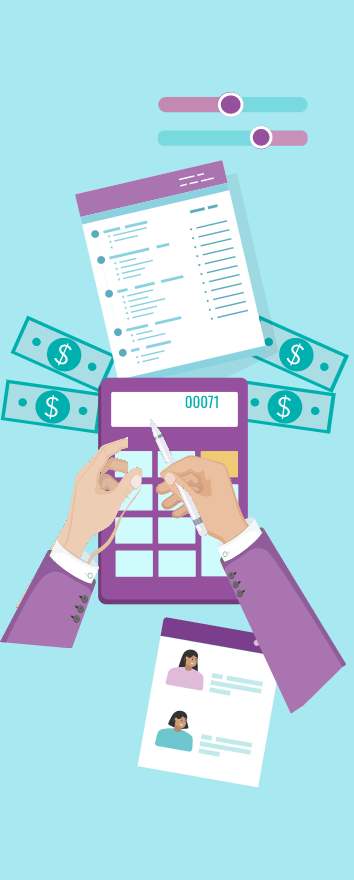

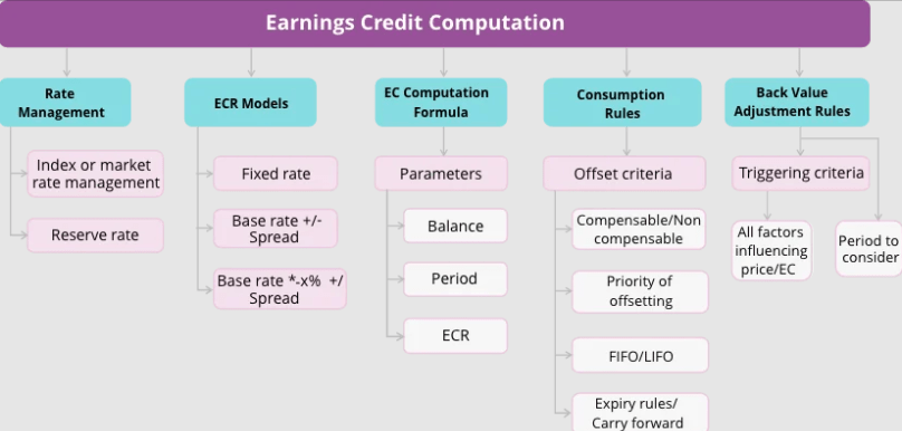

Calculating earnings credit or hard interest on accounts is typically based on a simple formula that considers the relevant interest rate, an average daily balance in the month and the time. Complexity can arise due to the number of permutations that are possible based on the specific corporate customer.

These permutations are the result of the bank’s strategies to attract and retain corporate customers and increase profitability. Customized bundling and pricing based on loyalty, size and profitability of the customer relationship have led to customers being classified into various “tiers.” Different rules apply to different tiers. Each customer consumes a different basket of banking services each month; and these baskets evolve as the customer’s business profile changes.

In addition to being driven by each individual bank’s own growth strategies and governance/risk management requirements, rules may also need to be tweaked based on competitor actions and regulatory changes. Banks must be able to make real-time customer-specific adjustments to how earnings credit and hard interest are calculated and applied to every individual corporate account.

For each corporate customer account, a bank must accurately calculate and apply Earnings Credit periodically. The table below lists the various parameters that need to be considered by a bank in the context of determining earnings credit and/or hard interest for each customer account. While the basic formula for calculating these elements is easy to implement, the number of options for each parameter increases the number of permutations.

For each period, the balance on which earnings credit is calculated is also a variable. It may be computed based on:

In traditional Account Analysis, the number of the customer’s balances that were required to be held in reserve by the bank were subtracted so earnings credit would not be applied. Additional changes made by the Federal Reserve have made this reduction unnecessary. However, some banks may still want to continue the reduction.

While banks typically generate account analysis statements monthly, the earnings credit may need to be calculated at a different frequency - daily, weekly, quarterly, annually or based on a contractually agreed billing schedule.

The frequency may also need to change from time to time.

Services offered by banks can typically be offset by earnings credit. These services are referred to as balance compensable or analyzed. For a variety of reasons, a bank may have certain services that cannot be offset with earnings credit. These services are referred to as non-balance compensable, or hard charges.

If the earnings credit in an analysis period exceeds the total of the analyzed service charges, the account is “in excess”. Typically, the excess earnings credits are lost, but banks can offer to carry forward excess earnings, giving additional benefit to the customer’s balances if there is seasonality to their cash flows.

Qualifying balance for Earnings Credit: $20 Million

EC rate: 1.00%

Days in the month: 30

Monthly bank charges: US$10,000

Hard Interest Rate applied to excess balances: 0.75%

Monthly Earnings Credit = Balance * EC rate * (Number of days in billing cycle/Number of days in the year)

Hence, EC for that customer for that month is $20,000,000 * 1.00% * (31/365), i.e., $16,986.30.

Hard interest on a hybrid account is calculated on the “excess balance” after earnings credit has covered all of the charges.

Per the above calculation, earnings credit for the month is $16,986.30.

Thus, the unused (excess) earnings credit is $16,986.30 – $10,000.00 = $6,986.30

Based on this unused Earnings Credit, the excess balance is calculated as follows:

$6,986.30 = Balance*1% * (31/365)

Hence excess balance is: $8,225,804.84

Hard interest credited to the account = $8,225,804.84 * 0.75% * (31/365) = $5,239.72

As may be seen from the above example, both for earnings credit and hard interest computation, banks will need to make necessary changes to the interest rate, relevant balance and time period for which the interest is payable. The value of these variables will depend on multiple factors. Some changes may need to be applied mid-cycle as well, depending on individual customer contracts or the bank’s risk management and governance policies.

Banks provide many services to their corporate customers. These include liquidity management, payments, collections, anti-fraud, and other treasury solutions. Each service has its own pricing structure; often, this varies with the customer and is agreed upon during the initial deal or renegotiation stage.

Banks generate Account Analysis statements for corporate customers each billing cycle. While the format of the AA statement varies with the bank, it will broadly contain details of what services the customer has consumed during the billing period, unit prices, volumes, the resulting service charge, balance requirement applicable taxes, etc. It will also contain calculations of the qualifying balances for earnings credit and the amount earned on those balances. It also helps in generating the actual invoice or debit to the customer’s account. For the customer, the AA statements provide account-level, drill-down details that enable them to reconcile their invoices (monthly, quarterly, or as per the agreed billing cycle).

On the other hand, banks use AA statements to help understand customer needs and project future revenue. This information is also useful in negotiating/renegotiating deals with customers. Accurate account analysis statements are a valuable source of data and insights for enabling banks to manage revenue, profitability, growth, and customer relationships.

The complexities explained in the preceding section apply to the generation of AA statements as well. From an operational standpoint, the complexity of the task increases because the multiple elements of data that are needed for generating Account Analysis statements are typically dispersed across disparate software systems. This is because most banks are organized based on products and services. When an AA statement needs to be generated for a customer, updated data needs to be captured, validated, and collated from multiple systems. If this process is not done efficiently, customer statements may contain errors; there is also the issue of the time needed to generate these statements and send them to customers.

SunTec Account Analysis software solution for banks a robust, secure, scalable solution that empowers banks to easily and conveniently address the complexities described in the preceding sections. The SunTec Account Analysis solution architecture allows it to be implemented as a wraparound or “middle layer” over existing legacy systems, using APIs to capture the relevant data from multiple systems. It acts as a single-point repository for key data and possesses the analytics capabilities necessary for customized pricing and billing, including generating real-time data-driven insights. This enables relevant sales and account management teams to better manage relationships and provide customized bundling, pricing and billing solutions that balance their corporate customer needs with the bank’s own financial imperatives around profitable growth. More importantly, SunTec’s scalable account analysis solution is built to take care of the future needs of a bank’s growth and expansion.

EC and hybrid interest computation and application are simplified because all parameters can be set/modified on the platform; the risk of data not being updated when EC is calculated, or AAA statements are generated is eliminated

The functional flow for EC/hybrid interest computation is illustrated below.

SunTec has implemented its middle-layer Account Analysis solution for leading banks in the US/North America and Europe