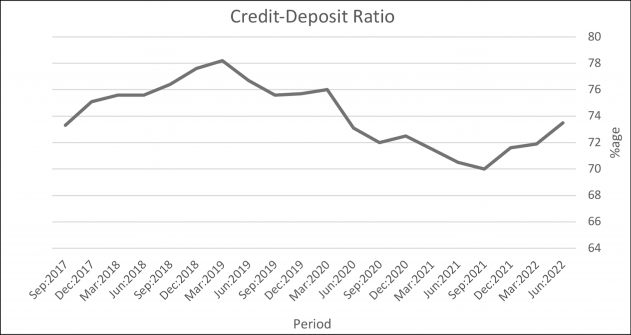

Source: RBI

Along with the increasing credit deposit ratio, over the last few months the incremental credit deposit ratio increased to INR 119. 95 (USD 1.47). This means that on an incremental basis, for every INR 100 (USD 1.23) deposit, banks have issued loans of about INR 120 (USD 1.48).

Evidently, there is now greater demand for advances and loans which translates into greater revenues and profitability opportunities for the bank.

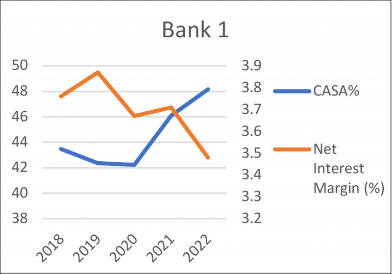

Current and savings accounts (CASA) are significant sources of funds and of maximum value to the bank, as they have relatively low to no interest rates, which most customers appreciate. The share of CASA deposits within banks has been increasing over the years and stood at 44.8% in March 2022 as compared with 41.7% three years ago. These low-cost deposits accounted for 60.9% and 55.6% of incremental deposits during 2020-21 and 2021-22, respectively. Banks, especially retail or universal ones would be more profitable if they could scale up their lending business as permitted by risk controls and regulations. But to lend more, banks need more funds. Increasing CASA deposits is the easiest way to increase funds as borrowing from external sources like investors is expensive and issuing certificates of deposits is difficult to sustain. In short, the higher the CASA ratio, the higher the net interest margin (NIM) for the bank should be. But does it always work out this way? We can analyze CASA and NIM trends across a few banks to see for ourselves.

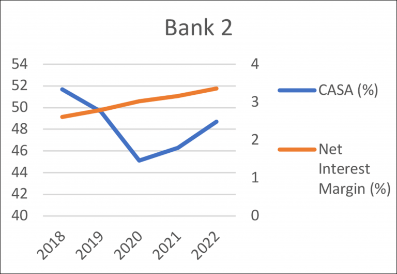

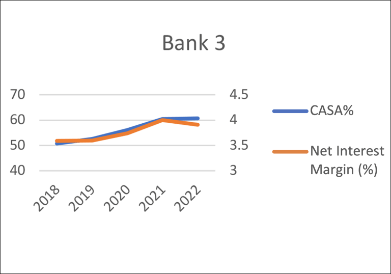

We will investigate data for five banks out of which the first three are large banks and the other two are small banks.

The CASA and NIM of the first two banks are not in sync. Ideally, an increase in CASA should lead to an increase in NIM. But in the case of the first two banks the CASA ratio and NIM trends are frequently not correlated and there is no consistency between changes in CASA ratio and changes in NIM. This is indicative of myriad challenges both banks are facing when trying to effectively utilize CASA balances. But the third bank demonstrates that it is indeed possible for a bank of comparable size to have a good correlation between the CASA ratio and NIM. Bank three also has higher CASA ratios and higher NIM when compared to the first two. Not only has this bank been able to effectively utilize the cheaper sources of funds, but it also has relatively higher profitability with a higher ratio of CASA deposits.

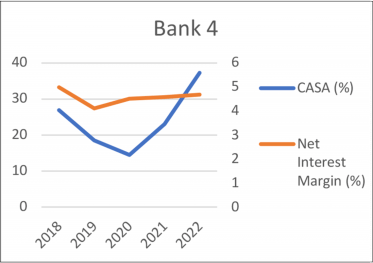

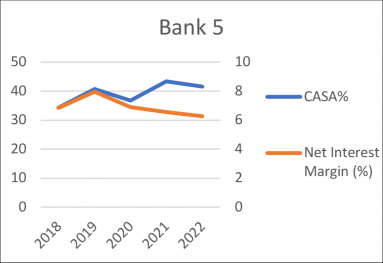

Let us also consider two small banks.

They both have relatively lower CASA ratios as they are still in their customer acquisition phase. But the CASA and NIM ratio for both banks follow the same trend and both have better NIM than the larger banks. This just goes to show that agile, new-age banks that can respond quickly to changes in CASA balances can ensure a greater return on their deposits. More importantly, if they continue to scale up even as they retain their agility, they can pose tough competition to their larger counterparts.

But is it possible for a bank to maintain higher CASA balances and derive better NIM from them? Can they respond quickly to changes in balances and more importantly implement a highly differentiated strategy to maintain their competitive advantage? The answer to these questions and more lies in the effective use of technology.

The key to revenue generation strategies for banks lies in a robust, cloud-native technology platform can capture and analyze real-time data to deliver actionable insights for quick decision-making. Banks can use this information to get the maximum value out of customer deposits by increasing CASA deposits and providing relationship-based advances and loans to customers. This is important for long-term customer loyalty. Happy customers who get the right value from a bank, will converge all their transactions into a single bank instead of working with multiple banks for different needs.

With the right technology platform in place, banks can attract the customer’s community or family by creating a notional pool of balances and analyzing that in real time to determine the preferential rate of loan interest that each community member can enjoy on their loans.

Right tools can enable relationship-based preferential interests to bring in more loan customers by analyzing current and historic data on the customer’s relationship and combining them with the depth of loan product that the customer uses.

Banks can be enabled also to provide telescopic rates to the customer where an increase in customer/community balances gives the customer access to preferential rates.

Banks can improve their loyalty programs with simple and easy-to-manage campaigns which are internally driven by the bank’s overall deposit levels. And they can give customers location and time/season-based preferential rates, which will help them respond quickly to external factors influencing interests and NIM.

At its core, the business models are the same across banks. They take in deposits, and loan out money and build their profitability on the interest on their loans. As competition gets tougher, banks must focus on building differentiated, efficient business models that bring in the maximum interest-based revenues. And a robust technology foundation is crucial for achieving this.