Price is all the information that exists in the market…it’s just what people think…. price means nothing other than the equilibrium of liquidity…It doesn’t mean it’s good or bad, it’s just where people agree. Price is a liar. – John Burbank

Somewhere in Iran, in 1979, a revolution erupted that set-in motion in a series of events that resulted in the overthrow of the Pahlavi dynasty and the establishment of an Islamic republic. The revolution, and the Iran-Iraq war that unfolded in the succeeding years created a shortage of oil that resulted in a drastic increase in the price of oil. The price which was around $65 for a barrel in the middle of 1979, shot up to more than $140 per barrel in less than a year.

Far away from the chaos in Iran, the residents of the US also felt the ripple effects. Roses, which were grown inside greenhouse chambers, suddenly became costly as gasoline was the key component used to warm up the greenhouse chambers. As a result, people began to shy away from buying roses for their loved ones and started to buy teddy bears, subsequently creating a huge increase in the demand for teddy bears. Rose farmers and teddy manufacturers used the increased price of oil as a signal to do two things respectively – move the rose farming from US to the African nations and increase the production of teddy bears.

In short, the price of oil acted as a signal – oil had become scarce. This scarcity became a signal for the rose farmers to shift their production to outside the US and became an incentive for the teddy bear manufacturers to ramp up their production. As the famous economists Tyler Cowen and Alex Tabarrok mention in their online website, a price is a signal wrapped up in an incentive.1

A price is not just a number. It is an invitation for prospective customers to try out a new product or a bait to lure a customer from a competitor. A price, in several cases, is the result of an in-depth psychological research. And in some cases, it is a point of reference for the customer to make a purchase decision.

Price Is a Point to ASPIRE

I believe that price, beyond a number is ASPIRE – Access point, Signal, Psychological trick, Incentive, Reference, and an Economic Indicator.

Price is an access point

Gillette, apart from its popular razor blades, that keep increasing in count every year, also inadvertently popularized a strategy that is used by many industries across the world today – the razor-razorblade pricing strategy.

Investopedia defines the razor-razorblade model of pricing as selling a product at a low price, maybe even at a loss, to sell a related product later for a profit. It is said that this model was popularized by the founder of Gillette, who reasoned that if he could offer consumers a sturdy, permanent razor supplemented by cheap, easily replaceable blades, he could corner the facial hair grooming market and create a massive, repeat customer base.2

Today this strategy is used by multiple industries across the world. Microsoft and Sony sell their gaming platforms at minimal profit or even at a loss to maximize their profit from the video games. App developers offer a freemium model and sell their apps for free to monetize on in-app purchases. Electric toothbrushes are sold at a throw-away cost in the hope that money can be made by selling the toothbrush heads. Ticket prices for baseball games are kept low so that customers splurge more on in-game entertainment and additions like food and beverages which are in many cases priced exorbitantly. In fact, for a couple’s movie night out, less than 40% of the total spend would be for the tickets, and the rest would be for popcorns, soft-drinks, dinner, and transportation.

The recent focus on SaaS companies is also a reflection of this trend. SaaS companies promise smaller chunks of recurring revenue than a big bite of upfront revenue which is more comforting for investors, and less taxing for customers.

In short, the price that a customer pays for a product is not the endgame, but it is just a beginning. Organizations have learnt that getting the customer hooked on to their platform of products and services is the key to start a strong and long relationship which can in turn lead to long-term revenue. And for that the price is not just a number, but an access point.

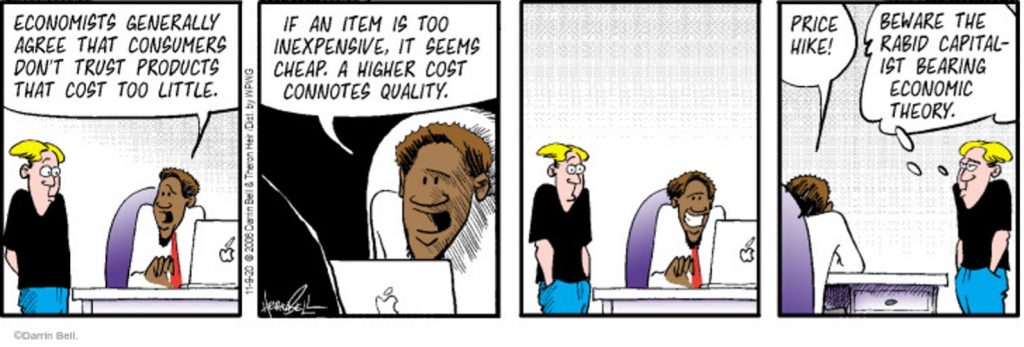

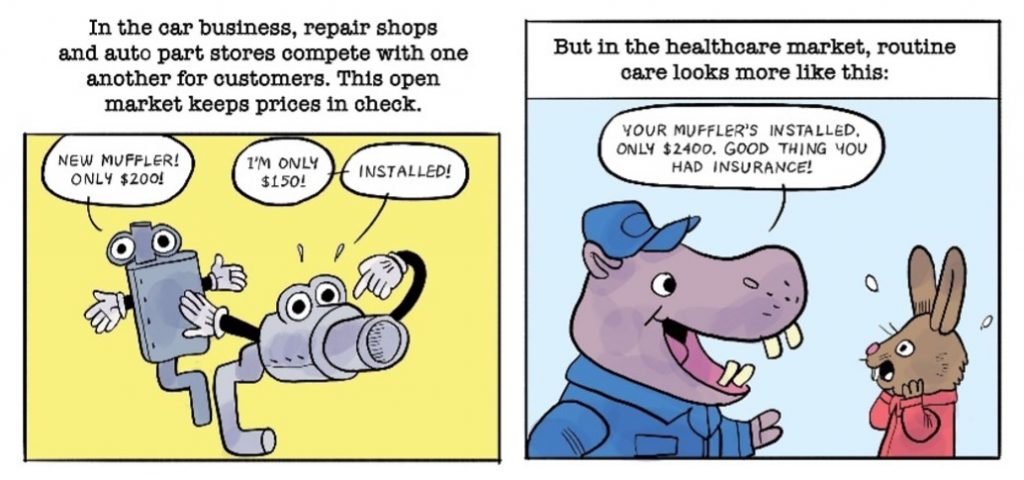

Price is a signal

Price – the price that you set, and the prices that you don’t set – has a strong power to communicate with customers and guide their perceptions. It is a signal based on which customers form assumptions about the quality of the product, the availability, or the scarcity of a product. And it helps them make the purchase decision. Let me explain.

Around the mid-2000s, a study was conducted in India to map the relationship between the price of a product and the customer’s perception of quality.3 In particular, the researchers sought answer to two questions – (1) Does high price have a positive influence on the buyers’ perception of product quality? (2) Is there a significant difference in the buyers’ perception of the quality of products falling in different price ranges? Three products were selected for the purpose of the study: color television as a durable product; T-shirt as a semi-durable product; and toothpaste as a non-durable product.

The major findings were that for a durable product, like color television, setting a very low price negatively affects the quality perception of the product and the customer would be reluctant to buy a low-priced brand as it might lower their image in the society. Even for t-shirts, a very low price was found to dilute its brand. For the toothpaste, brand reputation was found to be a critical factor and the marketer had to price the product according to the reputation enjoyed by the brand. However, the price-quality relationship for the toothpaste product was found to be weak in comparison to color television and T-shirt.

I believe that there are five major factors at play which decide the strength of a price as a signal – the market segment, the product maturity, the durability of the product, the customer understanding of the product, and the availability of the product. In a logical world, the number of possible combinations across these factors will be limited – the market segment can be three or four; the durability can be classified into low, medium, and high; the maturity can be mapped across four or five stages and so on. But sadly, we do not live in a logical world. And hence, the potential combinations can be limitless.

While setting, or revising a price, organizations need to consider these five factors, and plot the potential impact across them, to understand the strength and direction of the signal that the potential price change can make.

Price is a psychological trick

Go around a supermarket and notice the way they write down their prices. Of course, you will see several discounts being written down in large fonts, or numbers ending in 9. You will see several prices in red, and if you look closely enough, you may find that prices of many products do not have commas.

Pricing is ultimately a psychological trick. And organizations spent billions of dollars in researching the right method to price their products in the best possible way so that profits are maximized.

For example, our brains confuse visual sizes for numerical sizes, and it tries to make a connection between the price and the size of the product. Research tells us that we should generally display prices in a small font so that they seem numerically insignificant and discounts in a larger font so that the perception of savings are larger.4,5

Similarly, the price, when displayed without commas is perceived as lower compared to the same price when displayed without commas.6 The same impact is achieved when products have prices ending in 9.

The field of pricing psychology is vast, and it is not my intention to delve into the details of the same here. There is possibly research for every aspect of price – the way it should be written, the way it should be placed, the color that needs to be used, the number of products that should be used in a product bundle, the way alliteration should be used, and the way currency symbols should be used. I would not be surprised if there is research done that is suitable for a SaaS firm that wants to sell insurance for hoverboard owners in Cincinnati. Organizations need to find out the right pricing psychology – one or many – for their products and apply them judiciously because we live in a world of transparency and one wrong move can create a long-lasting negative impression.

Price is an incentive

Incentive is a magic word, and like magic, it is widely misunderstood. But it is magical, and it makes the customer act – and sometimes irrationally.

Incentives are a form of pricing manipulation that motivates and persuades buyers to act and complete a purchase. Discounts and providing free products just two of the many pricing incentives.

Amazon Prime is an excellent example of incentive. Amazon incentives the buyer to sign-up for their Prime membership program by offering them not only free and fast shipping, but also by providing them with free access to movies and music at no extra cost. Governments across the world are offering subsidies for their citizens to move into more environmentally friendly modes of transportation and power generation. Subsidies are also a form of incentives.

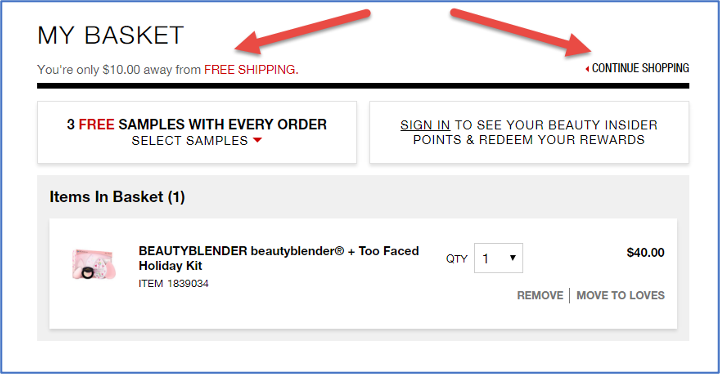

Pricing incentives can be used to drive up the urgency in taking a purchase decision. ‘Limited Time Offer’ is one of the greatest examples. In this case, the customers are forced to perceive that owning the product itself is one of the greatest incentives and make up their mind to buy the product.

But the key for incentives to succeed is to grab the customers’ attention but even when they do grab attention, it might be wrongly misinterpreted.

Incentives may not always work. Remember what I told you about prices being signals and a foundation for perceptions. For example, if you give a deep discount, people may perceive your product as one with a low quality, or it may signal that product availability is not in sync with product demand, or just the fact that you may soon be going out of business. In some cases, the incentives are displayed in a small font that many customers fail to notice the same.

In fact, Invesp, the experts in conversion rate optimization point out that ‘incentives are powerful and impactful when they grab the customers attention…and is combined with a call to action…and adding some unrelated images or texts near the incentive area can be a distractor for customers’.

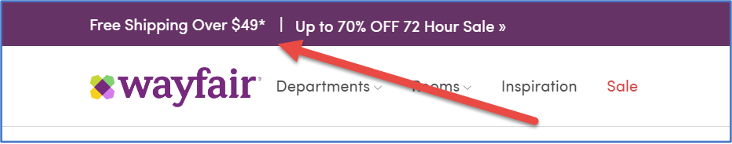

In the first image, as Invesp points out that ‘Sephora, the e-commerce store, informs its customers how much is left till they can get free shipping and immediately offers them to continue shopping’. Here, free shipping is the incentive, and it is not a price that is linked to a number. In the second image also, we are presented with incentives which are not linked to a number, but Wayfair put both the incentives close to each other which could be confusing to some visitors.7

Source: Invesp blog

I believe that organizations have a great opportunity if they understand the power of incentives and move beyond treating incentives as a function of discounts and free offers. The prices that an organization sets for its products, the offers that it gives, and the terms and conditions of the purchase can all be considered as incentives, and it is important that organizations consider this while deciding their pricing strategy. Balance is the key.

Price is a reference

In Neil Davidson’s amazing book Don’t Just Roll the Dice, he writes:

People base their perceived values on reference points. If you’re selling a to-do list application, then people will look around and find another to-do list application. If they search the internet and discover that your competitors sell to-do list applications at $100, then this will set their perception of the right price for all to-do list applications.

People always use the price of an existing product as the reference for a new product and use the price of a comparable product as the reference for a new product. When a new phone model is introduced, people compare it with the price of the previous phone model. When the Model T was introduced at $825, the people compared it with the cost of getting a horse carriage. There is no escape.

There is no dearth of price comparison sites and videos which break down a product into its bare bits. Thanks to them, price is used as a point of comparison and reference not just in a linear fashion, but in a multi-dimensional way, more than ever.

But customers do not remember everything. In his book Predictably Irrational, Dan Ariely talks about a wonderful experiment which can be a case in study about reference prices. In the experiment, conducted by MIT professor Drazen Prelec, 55 students were shown a bottle of a Côtes du Rhône Jaboulet Parallel wine and were then asked to do an unusual task – they were asked to jot down the last two digits of their social security numbers. Post this, the students were told more about the wine in detail and were also shown another bottle of wine which was much more rare and much more vintage. In turn, Drazen held up four other items: a cordless trackball (TrackMan Marble F X by Logitech), a cordless keyboard and mouse (iTouch by Logitech), a design book (The Perfect Package: How to Add Value through Graphic Design), and a one-pound box of Belgian chocolates by Neuhaus. Then he passed out forms that listed all the items and the students were asked to write out the last two digits of their social security number and the value they were willing to pay for each of the products along with the wine bottles. Surprisingly, as Dan Ariely mentions, ‘the students with the highest-ending social security digits (from 80 to 99) bid highest, while those with the lowest-ending numbers (1 to 20) bid lowest. The top 20 percent, for instance, bid an average of $56 for the cordless keyboard; the bottom 20 percent bid an average of $16. In the end, we could see that students with social security numbers ending in the upper 20 percent placed bids that were 216 to 346 percent higher than those of the students with social security numbers ending in the lowest 20 percent’.

This is an example of the concept of reference playing out in our everyday lives. In this scenario, it was called the arbitrary coherence.

Price will always act as a reference even when we are not conscious of the same. Organizations need to understand the extent that customers can use price as a reference and price their product accordingly.

Price is an economic indicator

In the last quarter of the 18th century, the typical worker spent half of his or her daily wage on bread. But, due to multiple calamities, when the grain corps did not produce the intended harvest in 1788 and 1789, the price of bread shot up nearly 90 percent. Many people blamed the rich nobles for this increase and the resulting famine. Moreover, the poor working classes were also unhappy about the gabelle, a tax on the salt, a key ingredient for bread, that was unfairly applied on the poor. This increase in the price of the bread was the cause of the French Revolution which resulted in the beheading of King Louis XVI and the queen Marie Antoinette.8

This is the importance of prices – prices define the economy, and can create uprisings and lead to revolutions, and possibly result in governments being overthrown. Everyone knows what happened in Sri Lanka in 2022. Prices, and especially prices of essential items, are the fundamental building blocks of a nation’s economy.

In 1986, The Economist invented the Big Mac Index, a light-hearted guide to whether currencies are undervalued or overvalued. Over the years, it has become a global standard for how the prices in one economy are faring compared to another economy. It is not just the Big Mac Index, but consumer price indices across the world are calculated using the prices of key items.

In fact, price plays a key role in the global economy – it acts as a signal for the availability of a product. The ‘invisible hand’ that Adam Smith talked about is a result of the price fluctuation. Careful management of prices can help organizations and nations manage the supply and demand of a product. For example, when India faced a shortage of wheat in 2022, India banned the export of wheat (which is akin to levying a very high export duty) to ensure food security. Nations across the world levy a high tax on tobacco products to discourage citizens from buying them. Nations subsidize electric vehicles to promote the use of vehicles that are more environment friendly.

The impact of prices in shaping the direction of an economy is very significant. A small change in the price of a product can create a ripple effect that can make or break not just organizations, but also the economy of several nations. It is important that not just the organizations, but also national leaders understand this.

The Truth About Prices

As Keith S Coulter and Robin A Coulter point out in their research Size Does Matter, humans do not have a straightforward relationship with price.9 They say – “An assumption of classical economic theory is that comparative price information is processed in a conscious, deliberate, and rational manner… Consumers are presumed to have perfect information about the prices for a set of products, as well as the utility received from those products. Such may be the case in retail point-of-purchase settings, in which prices can be directly observed and compared. However, recent studies have demonstrated that buyers do not always process pricing stimuli in a conscious, deliberate manner, but instead frequently rely on the nonconscious, automatic processing of price information… These consumers make decisions based on what they implicitly know, rather than what they explicitly remember…”

As I mentioned before, price is not just a number. It is a signal that is fundamental in deciding the success of an organization and the future of a nation.

It is important to understand that the price that a customer pays to an organization for a product is not part of an isolated transaction but is the result of a series of interactions and decisions that happen over an extended period, both before and after the purchase. Price is like a moment in an episode of an extended web-series running over several seasons, consisting of several such moments, several actors and several more stakeholders. It may not be the most important moment, but it will be one of the more important moments, which can set the tone for the rest of the episode and the series. You spoil the moment, you spoil the entire episode, and potentially the entire series.

The Final Word

Organizations need to understand that the price that customers pay is not just a number, but a point to ASPIRE for – Access point, Signal, Psychological trick, Incentive, Reference, and an Economic Indicator.

The impact that a change in price may be difficult to understand and quantify but is important to understand the key aspects of what a price means for the customer and organizations need to set the price accordingly.