Meet us at Sibos 2022, Amsterdam

Associate Director Sales – UK&I and EMEASunTec Business Solutions

So, think no more, and become a customer-driven organization today! Meet our leaders at our booth.

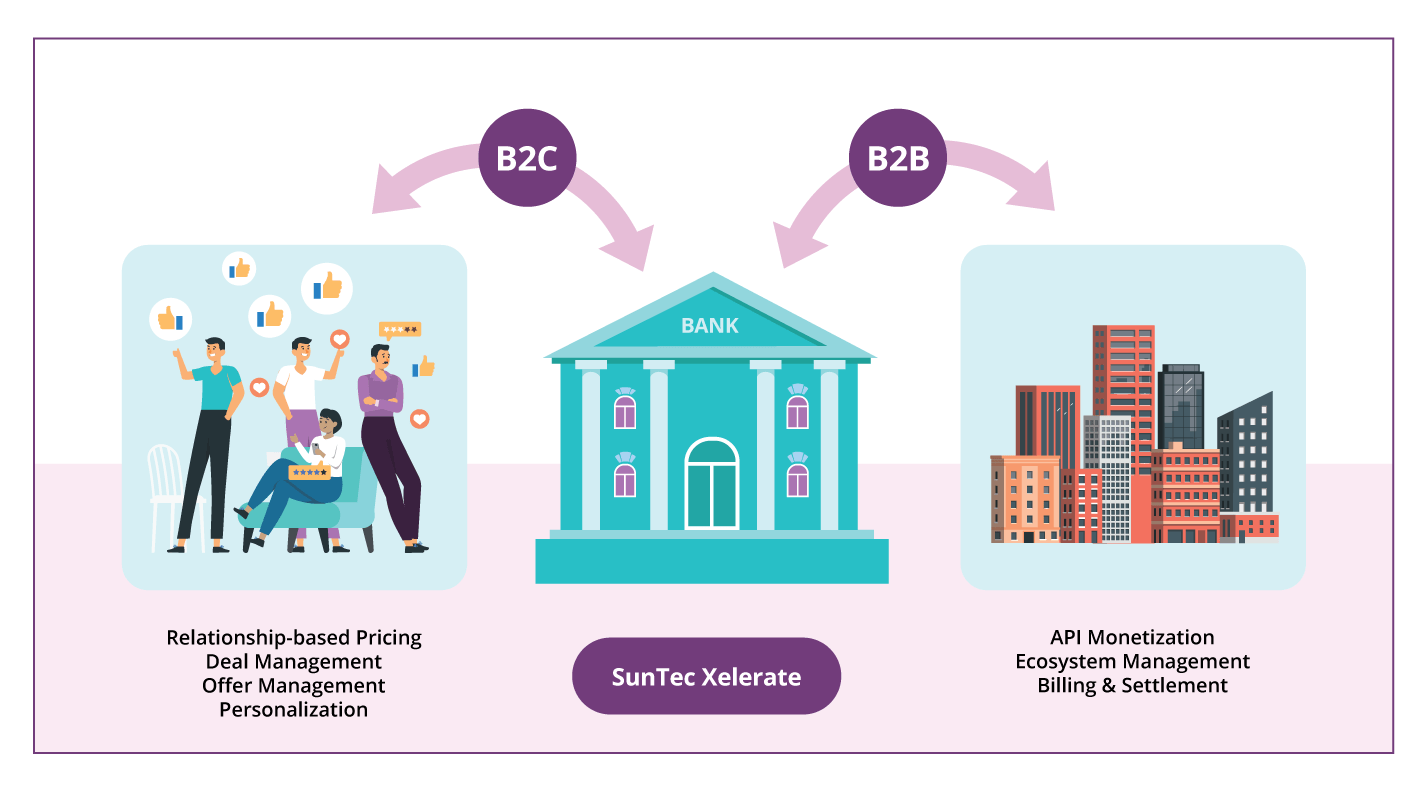

The onset of BaaS has broadened the scope of banks becoming a part of larger ecosystems from the ones they typically operate in.

With the rise of an API economy, Banking-as-a-Service is gaining traction, making banks rethink the kind of customer experience they can deliver.